Outsourcing your accounting may seem unnecessary or expensive at first, but by doing so, you’re likely to save money in the long run. If you decide that hiring an accountant will be most beneficial for your business, you might wonder how to find one. Finding https://www.quick-bookkeeping.net/ an accountant that fits your business’s needs requires some research. The lack of local-currency lending pushes up borrowing costs and in many cases is the primary reason behind the much higher cost of capital in EMDE compared to advanced economies.

The state of AI in early 2024: Gen AI adoption spikes and starts to generate value

A knack for numbers and a passion for financial performance can help you get into a career where you’re sure to thrive and make a difference. This online accounting degree empowers you to help organizations meet standards and obey laws, benefiting individuals, companies, and entire communities. Calculate your consulting retainer fee the same way you’d do your project rates—it’s essentially a comprehensive monthly project rather than smaller one-off assignments. Some consultants offer discounts for retainer fees as they’d prefer consistent income over hourly or per-project invoices. If you don’t have much experience, find an initial client and offer to do work for a discounted price or free. Focus on delivering the best results possible, which means don’t try and get additional clients.

The Value of Hiring a Professional Accountant

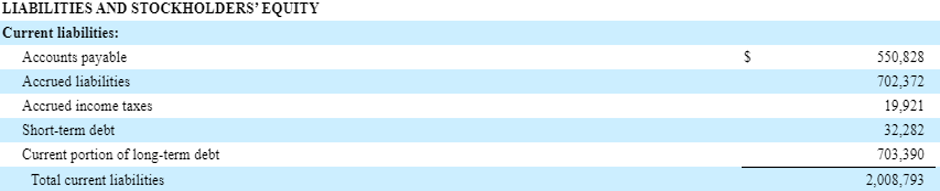

Most small-business accounting software costs $0 to $150 per month, with basic plans starting at $0 to $40 per month. These plans allow small-business owners to easily track income and expenses, create and send invoices, and put together financial statements and reports. Because these two methods are based on the specific services, savings, or worth of the work performed, finding an average accounting cost for these two methods of payment can lead to inaccurate numbers. Fixed-fee and hourly rates are easier to calculate average accountant costs because they are not always such specific situations. Your small business is booming, sales are strong and you’re on track for a record year.

File and pay what they can to reduce penalties and interest

Even companies that are the same size and industry pay very different amounts for accounting. Before we get into dollar figures, let’s talk about the expenses that go into small business accounting. The higher this is, the more you can expect to pay – after all, the tax and accounting workload placed on your accountant will be higher. For example, the cost of maintaining your business accounts depends on your monthly turnover. Where possible, use software to handle some of your accounting responsibilities.

- The end value is different from the input—and your consulting fees should reflect that.

- Often, the project rate will be the accountant’s hourly rate multiplied by the number of hours they believe it will take to complete the project.

- While there are some basic financial tasks you can handle yourself, there are others that it’s best to leave to a professional.

- As in all things, there is more than one way to determine an accounting cost.

- An accountant is at a higher level than a bookkeeper, and typically in an organization a bookkeeper would report to the accountant.

- It’s especially helpful to have an accountant to help you prepare tax returns or any other type of government form.

What type of consultants makes the highest fees?

Because your needs might change, you should evaluate your expenses periodically. For businesses, tax preparation costs can be even higher, as they often need to file additional forms such as Form 1120S for S corporations, https://www.business-accounting.net/decision-making-framework-top-6-frameworks-for/ which can cost upwards of $9031. It is important to note that these average prices can be influenced by factors such as geographical location, experience, and services offered by the tax professional.

To set your accountant’s fees, you need to consider the professional services your business requires from the accountant. The type of services they offer and how frequently they offer them will determine how much to pay them. For example, if you require them for tax planning and filing, payroll management, auditing and consulting, they will charge you more than when all you need is tax preparation.

Many consultants and freelancers make the mistake of confusing average consultant rates with standard pricing—that’s not the case. Averages don’t take into account your value, the scope of work, client perceptions, or even your cash flow. This tip goes beyond value, the scope of work, and client perceptions—you have to set prices that’ll lead to adequate quality of life and profitability for your business. However, if you set your rates too high, you may alienate yourself from the client and out price yourself out of the project. Clients may perceive you as the high-end of the consulting or freelance market, and they may decide to settle for a less experienced but more affordable alternative. When you hire an accountant, you can save on time, money, and resources, giving you more flexibility and energy to pour into other parts of your business.

This reduces the tasks you need an accountant to do, saving you money on accountant fees. SCORE – a resource partner of the Small Business Administration (SBA) – worked out how much money small business owners spend on accounting each year. If you fall within a certain income bracket or are a senior citizen, you may qualify for tax filing assistance. The Volunteer Income Tax Assistance (VITA) provides free tax preparation services to people who earn $60,000 or less per year.

It’s invigorating when your client pays your invoice, and those dollar figures spring up in your bank account. But remember, revenue builds momentum, but profitability keeps your business alive. Instead of altogether rejecting the client (or the client rejecting you), steer the client towards negotiation. Understanding what the client needs (and how well they understand it themselves) play a major role in how you price or whether you want to move forward at all. Toss out a number too early, and it might be hard to change it later if the project evolves.

While there are some basic financial tasks you can handle yourself, there are others that it’s best to leave to a professional. Well, that depends on what you’re looking for and the expertise you require. Get updates on the IEA’s latest news, analysis, data tax depreciation section 179 deduction and macrs and events delivered twice monthly. Grids have become a bottleneck for energy transitions, but investment is rising. Investment in Latin America has almost doubled since 2021, notably in Colombia, Chile, and Brazil, where spending doubled in 2023 alone.

Then consider running another cost-benefit analysis to ensure the benefits outweigh the costs. In that case, you might only need to hire an accountant during tax season or for a limited time monthly, which will decrease the costs. Accurate accounting helps you do a lot, including maximizing tax deductions and making better financial decisions. Respondents most often report that their organizations required one to four months from the start of a project to put gen AI into production, though the time it takes varies by business function (Exhibit 10). Not surprisingly, reported uses of highly customized or proprietary models are 1.5 times more likely than off-the-shelf, publicly available models to take five months or more to implement.

In AdvisoryHQ’s detailed review, we will be taking a look at the average accountant fees. The average cost of an accountant can encompass a significant range depending upon the location of the accountant, the services offered, and the fee structure each accountant chooses to implement. Some offer personal financial planning services, human resources or technology consulting, startup assistance, estate planning advice, and more.

Operations and Supply Chain Management provides a streamlined introduction to how organizations efficiently produce goods and services, determine supply chain management strategies, and measure performance. Emphasis is placed on integrative topics essential for managers in all disciplines, such as supply chain management, product development, and capacity planning. This course guides students in analyzing processes, managing quality for both services and products, and measuring performance while creating value along the supply chain in a global environment. Intermediate Accounting III provides comprehensive coverage of investments, revenue recognition, accounting for income taxes, pension plans, and leases. The course explores further advanced topics, including accounting changes and error analysis, full disclosure requirements in financial reporting, and interpretation of the statement of cash flows.